Unlock promotions, career opportunities, and extra income with Python.

Getting Started With Python for Quant Finance has helped 1,000+ students get started with Python and achieve life-changing results.

No theory. No jargon. Just practical Python you can use.

Join 1,000+ alumni that are using Python to make money.

This was the best course I have taken in my 28 year career in finance.

- Zarko, Finance Professional, March Cohort

Live Sessions with a Quant

Get your questions answered in real-time so you never get stuck. Live group sessions from a practitioner with 20+ years of experience as a trader and quant.

Working Code Templates

Pre-built templates for algorithmic trading, options pricing, and more. Use them as-is or modify them for your purposes. Code to get started immediately.

Real-World Applicability

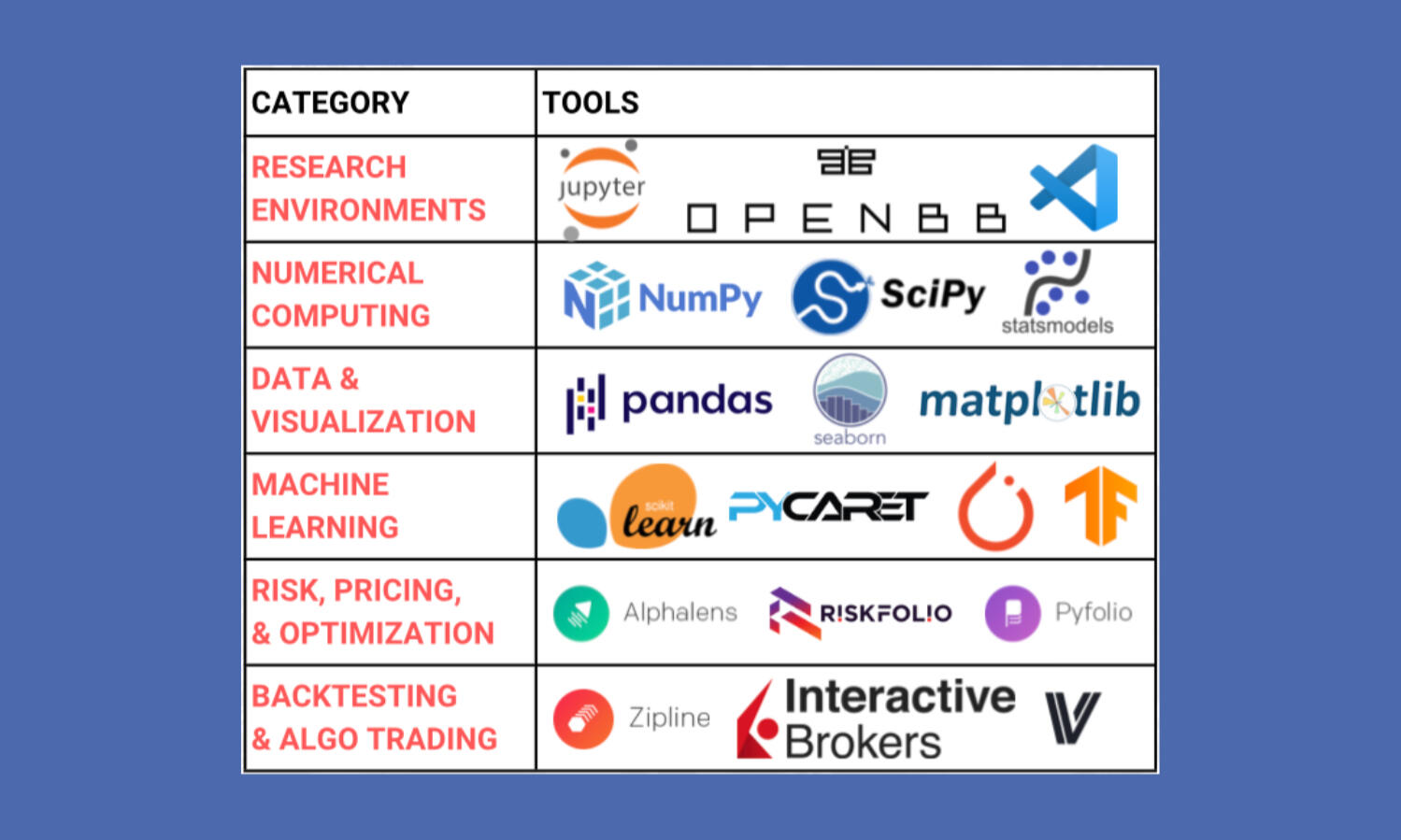

You won't learn a bunch of theory that doesn’t help you in real life. You'll learn how to use the same tools as the pros so you're never behind the competition.

You know Python can help in a lot of ways:

Get a new job

Stand out at work

Advance your career

Earn passive income trading

Improve your trading performance

You know to unlock these goals, you need Python for data, analysis, and trading.

So you took a $19 online course.

You learned how to build a tic-tac-toe game from someone that has never traded, done financial analysis, or even worked in finance.

Or more useless theory that doesn't get you any closer to your goals.

I've been there.

If you’re new to Python, you probably start by googling "python tutorial." Then you see the 533,000,000 results, scroll for a few seconds, then jump to the first paid ad you see.

You've read the blogs, watched YouTube, and taken all the courses.

But actually using Python for quant finance in real life (and not just for toy examples)?

That can seem like something other people figure out, not you.

Instead, you're...

Taking courses with no practical application, examples, or real-world projects

Wasting time on one-size-fits-all tutorials focused on syntax—not quant finance

Buying recorded courses that leave you with broken code, "magic solutions," outdated libraries, and no one to help you

Totally lost with where to focus your attention to get the concrete skills and experience you want

Stressing out about actually applying what you learn so you can improve your job prospects (or quit your job altogether)

Sound about right?

It's one thing to "learn Python." But it's a completely different thing to use Python for quant finance.

For many of us, getting started with Python is a mystery.

You know there is immense power at your finger tips, but you just can't quite figure out how to go from theory to practice.

Modules, IDEs, swaps, options, Jupyter, functions, automation, backtesting, loops, classes, CVaR, Sharpe, list comprehensions, walk forward analysis...

People may as well be speaking another language.

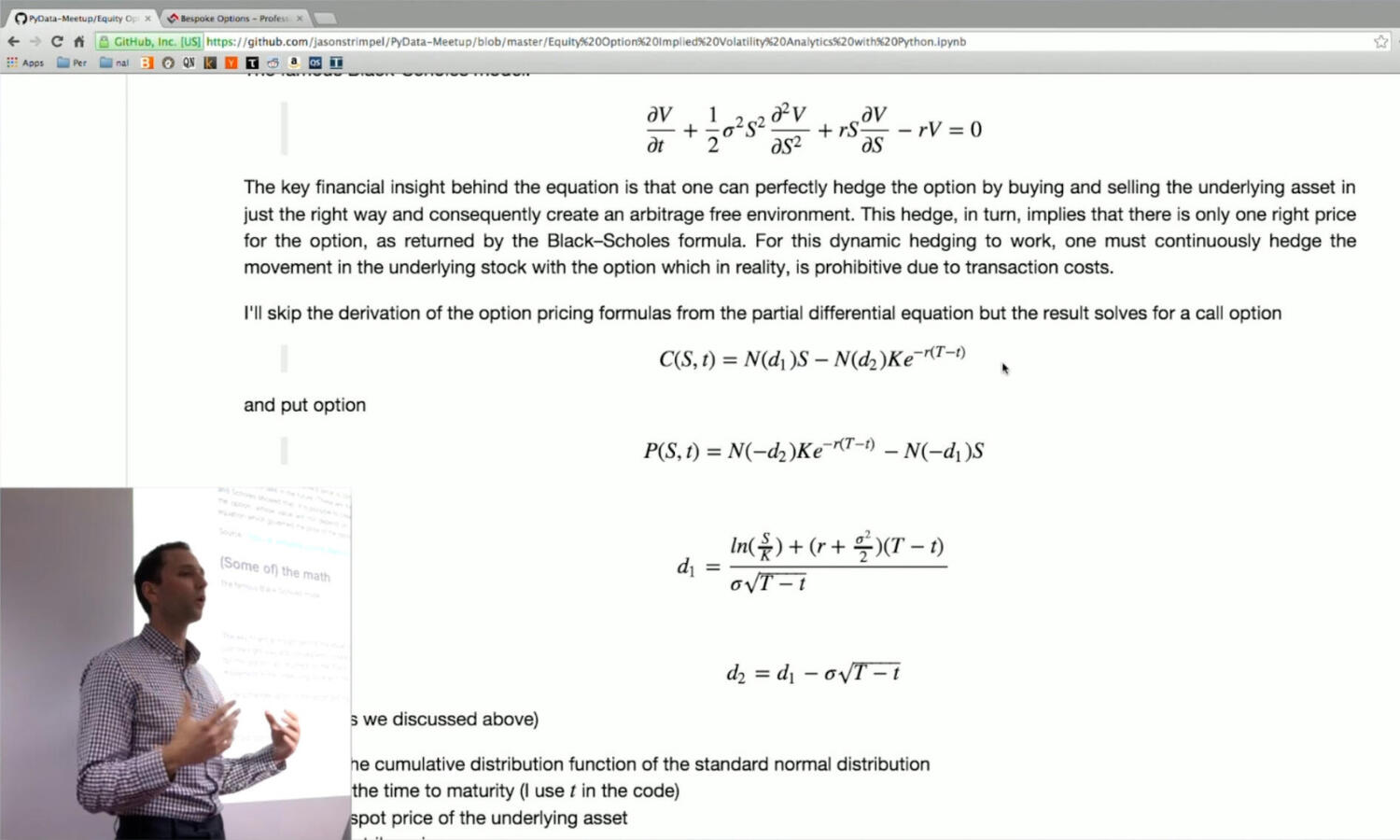

Me explaining how to price options using Python in Singapore (2015).

Hi there, I'm Jason and I'm the creator of Getting Started With Python for Quant Finance.

I can translate that language for you.

I've been trading for over 20 years, a quant for 15, and a daily user of Python for 12.

In October 2022, I started helping other people learn how to put the three together.

The course gave me the materials I needed with a mentor to guide me along the way to achieve my end goal of landing an active trader role.Jason gets straight to the point and avoids all the fluff that other courses use that wastes a tremendous amount of time.

Nick, Active Trader

November Cohort

Over the years, I've helped hundreds of finance professionals, developers, and complete beginners use Python for quant finance. I've done this through keynote talks, Meetups, Twitter threads, LinkedIn posts, in-depth articles, newsletters, and my course Getting Started With Python for Quant Finance.

But Getting Started With Python for Quant Finance is not actually a course.

It's not theory.

It's not jargon.

It's not printing "Hello World" to the screen.

Included is an entire framework to get you started with Python for quant finance.

It's a complete set of step-by-step, proven frameworks that gives you:

Engaging, live group sessions for real-time answers

An experienced, hands-on instructor to guide you every step

1,000s of lines of quant code you can use to kick start your projects

A 1,000+ strong community of like-minded beginners to crowd-source answers, code, and strategies

Industry Speakers from firms like Man Group, SigTech, OpenBB, CrunchDAO, ThetaData, and QuantConnect so you can network with industry practitioners

A structured, step-by-step path to getting outcomes with Python

Accountability and support to help you when you hit a speedbump

So what does all that actually mean?

It means that you won't waste time learning Python you can't use. It means you'll get the skills for a new quant job or to start trading from home.

You get the same quant tools I used to analyze $20 billion of derivatives credit exposure, manage $100 million book of CVA, manage a global team of quant engineers, and trade stocks and options.

So if you're struggling to get started with Python for quant finance, this course is for you.

I have been trying to get into algorithmic trading for 2 years. After taking this course, I have finally been able to consolidate and focus on what I need.Jason provides what you need to get started correctly and the tools you need to continue developing.An excellent course for finance professionals interested in Python. I could have saved many hours if I had found it earlier.

Hector, Financial Analyst

March Cohort

What's Inside

Inside you'll find real-time answers, code to get you started, and hundreds of people for networking, sharing ideas, and accelerating your progress. To maximize your investment, you'll also get video replays, a written course curriculum, and more than $4,500 of free bonuses.

10 live sessions, 2 office hours sessions, 3 Industry Speakers, and the PQN Pro community

PQN Pro:

Get support and accountability from the PQN Pro community

Get personalized answers fast, detailed code walkthroughs, and help fixing code bugs.

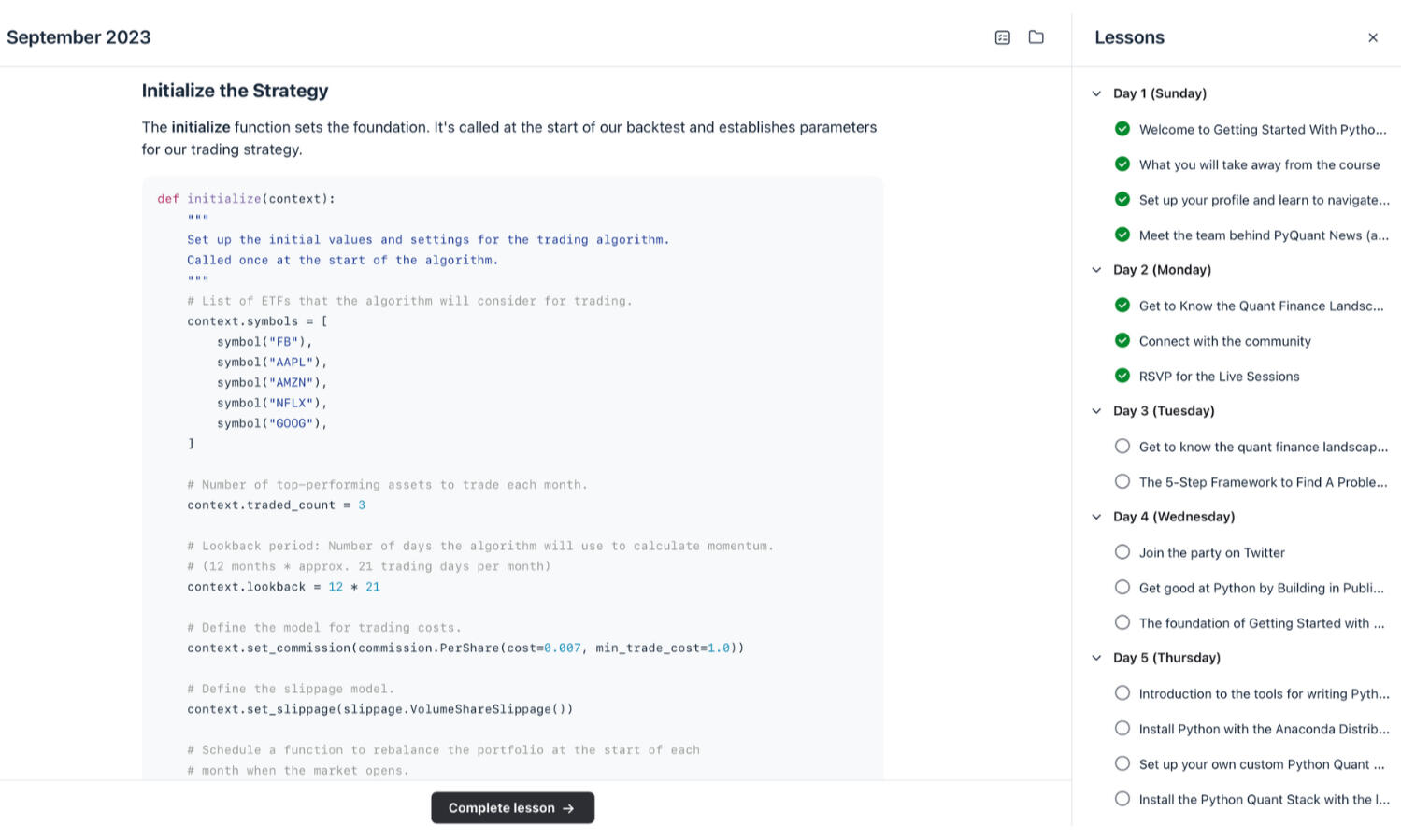

Onboarding Week:

An entire week of self-paced activity to get ready for the course

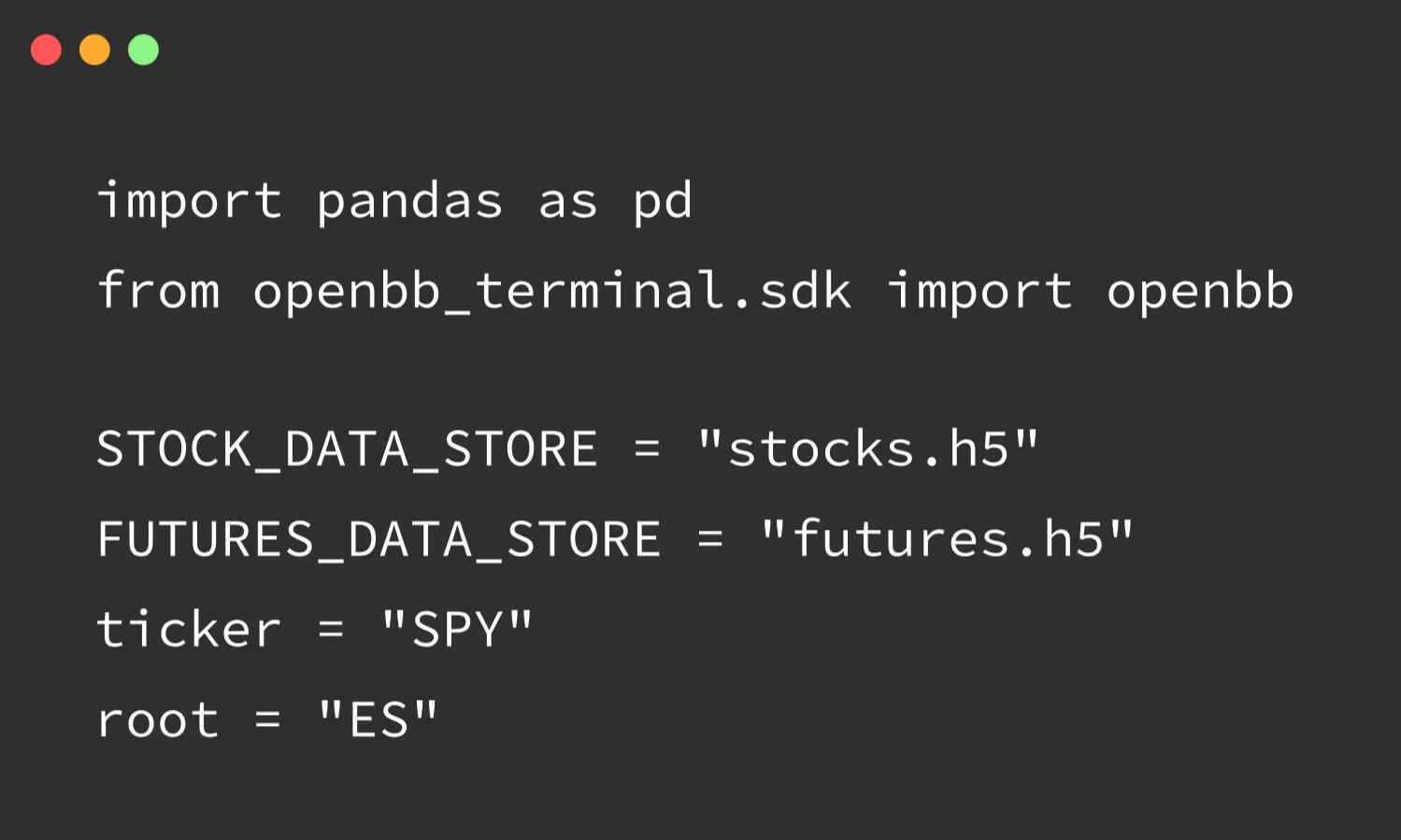

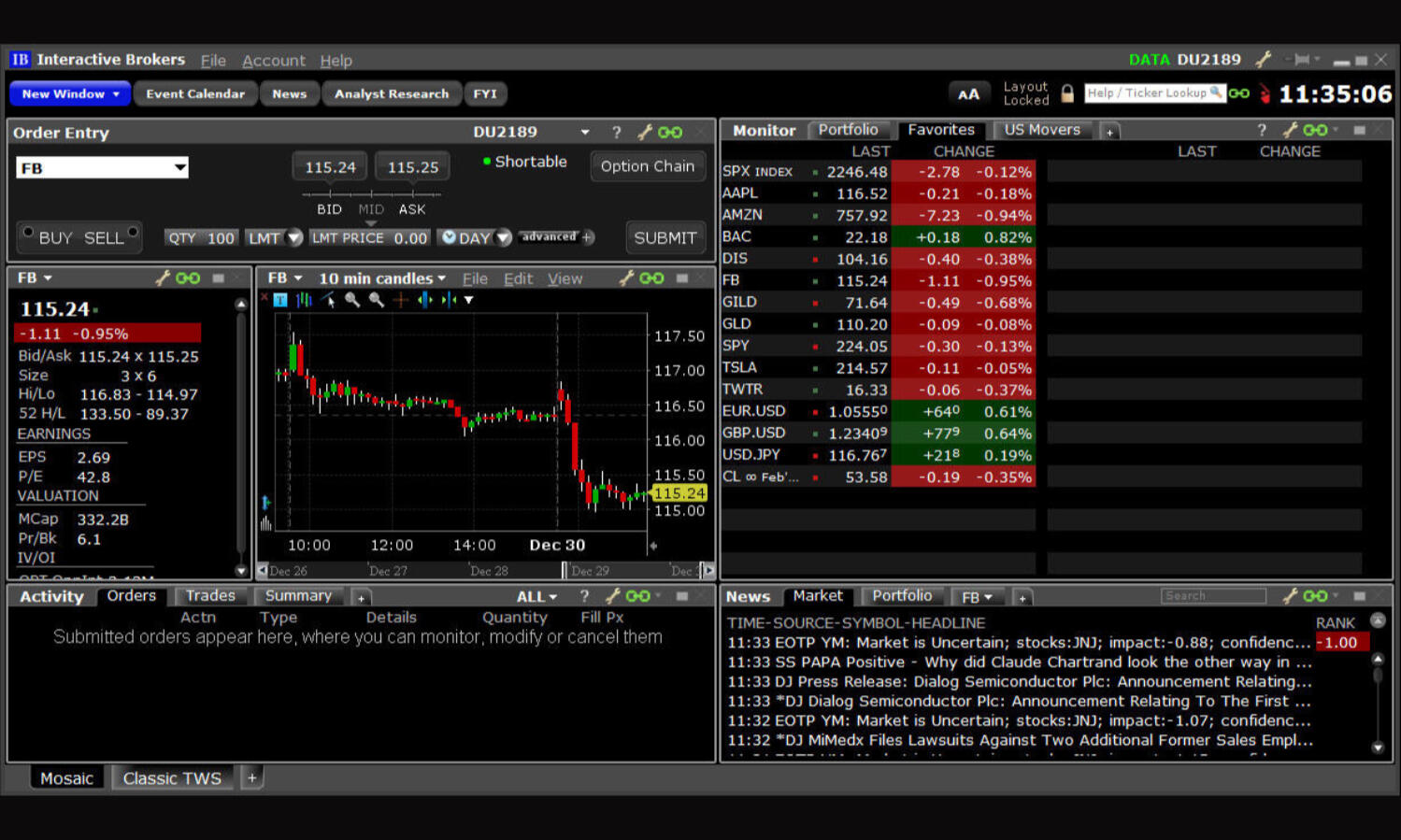

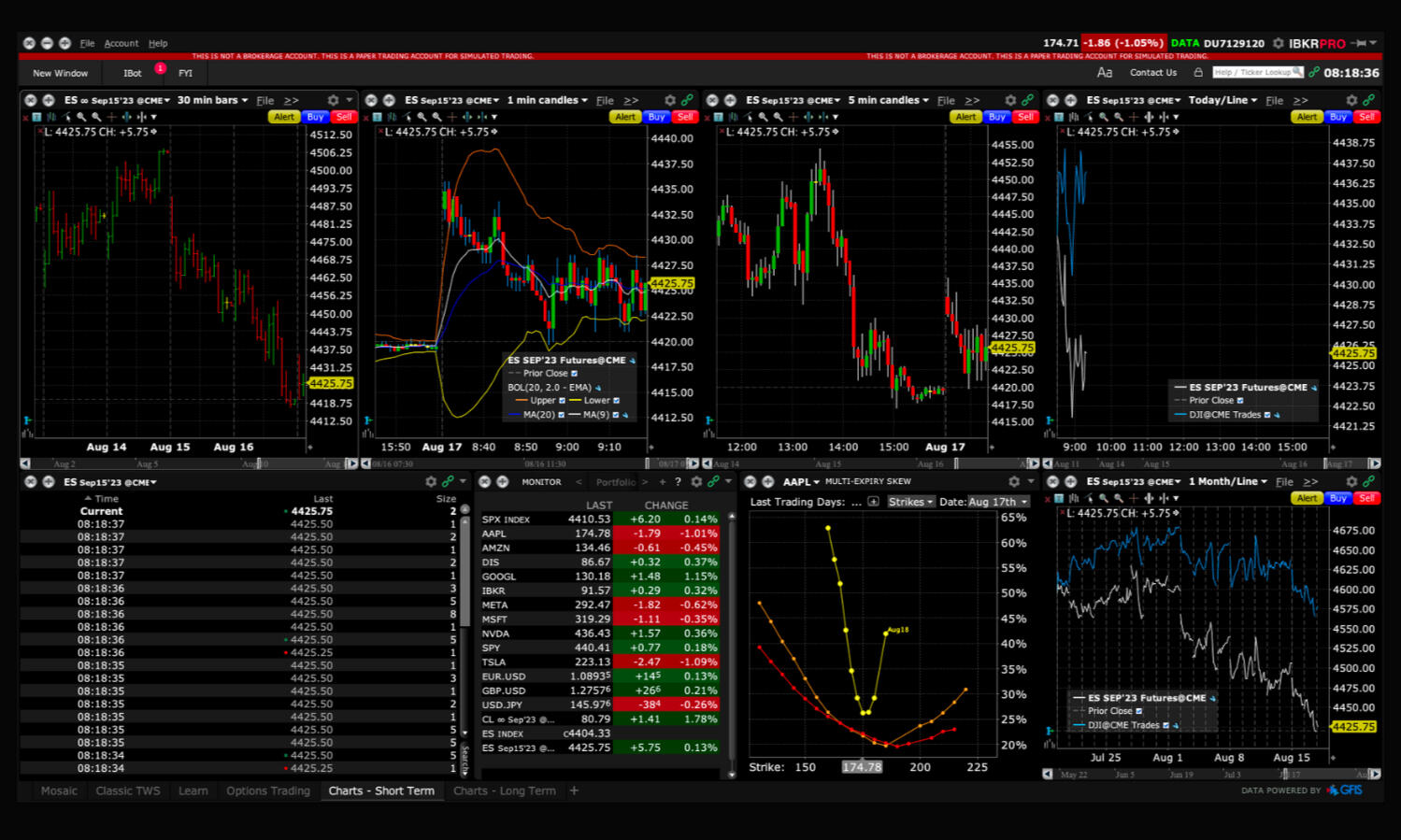

Install the Python Quant Stack, download market data, and connect to Interactive Brokers—all with step-by-step instructions.

Live Session 1:

Getting the Python Basics Right

If you're brand new to Python, you'll fast-track your learning with exactly what you need to know—no overwhelm, no complexity

Live Session 2:

The Python Quant Stack

Get familiar with the finance-specific Python libraries for algo trading and data analysis so you can work with market data

Live Session #3:

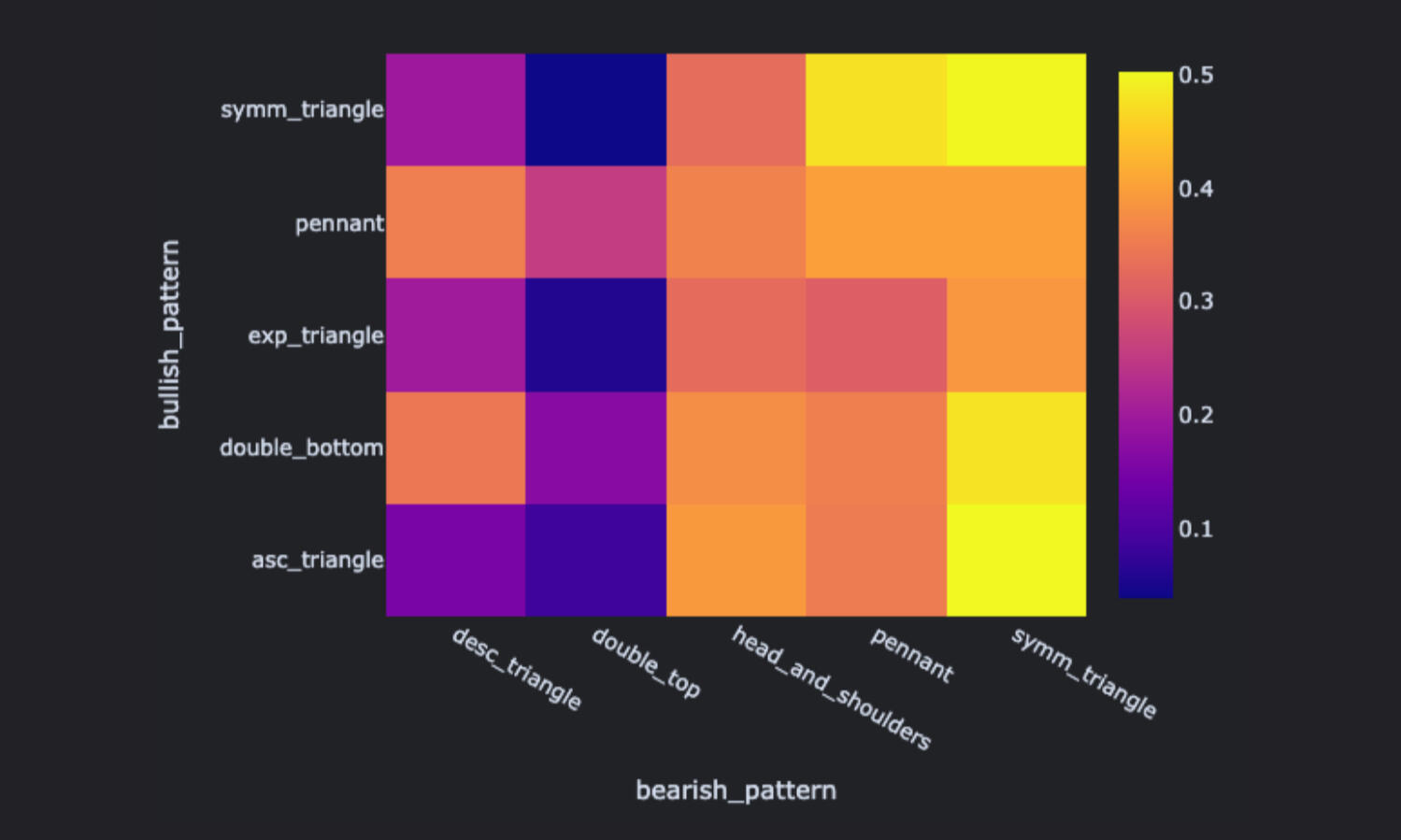

Algorithmic Trading for Non-Professional Traders

Yes! Retail traders can compete. Get a framework to form trading ideas, test them, and get them executed

Live Session #4:

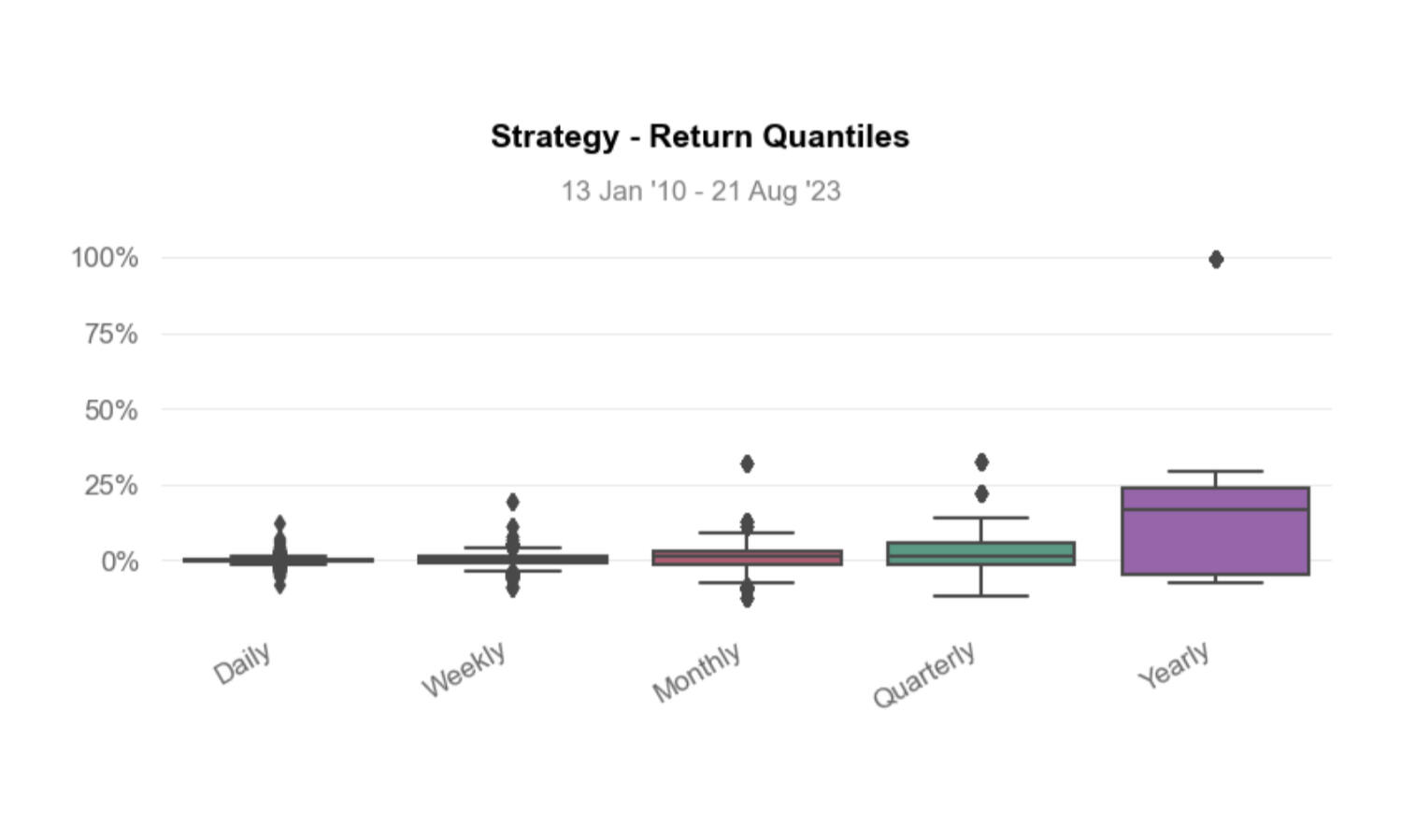

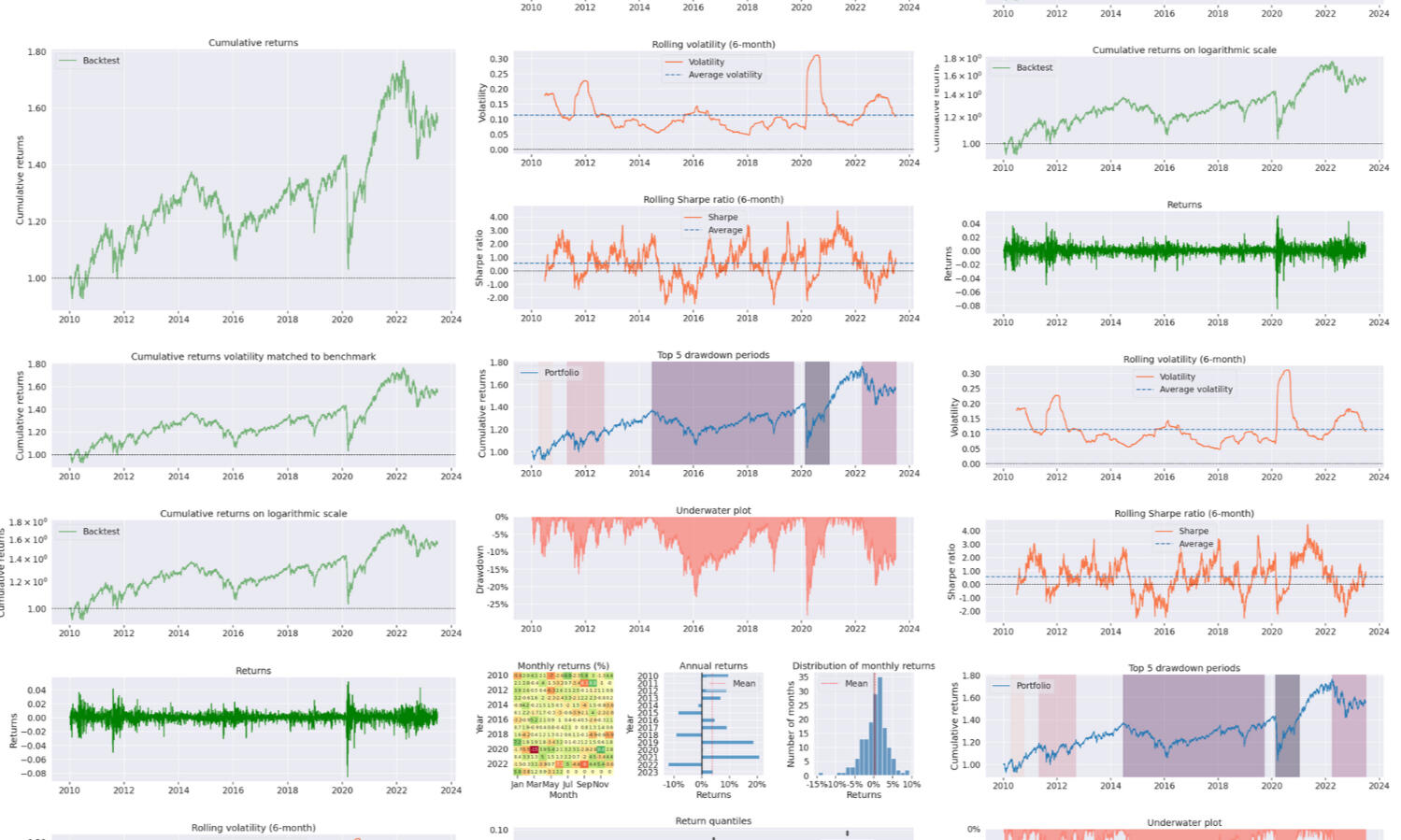

Treat Your Backtest Like an Experiment

Understand why most people get backtesting wrong—and the secret of how to avoid losing money because of a backtest

Live Session #5:

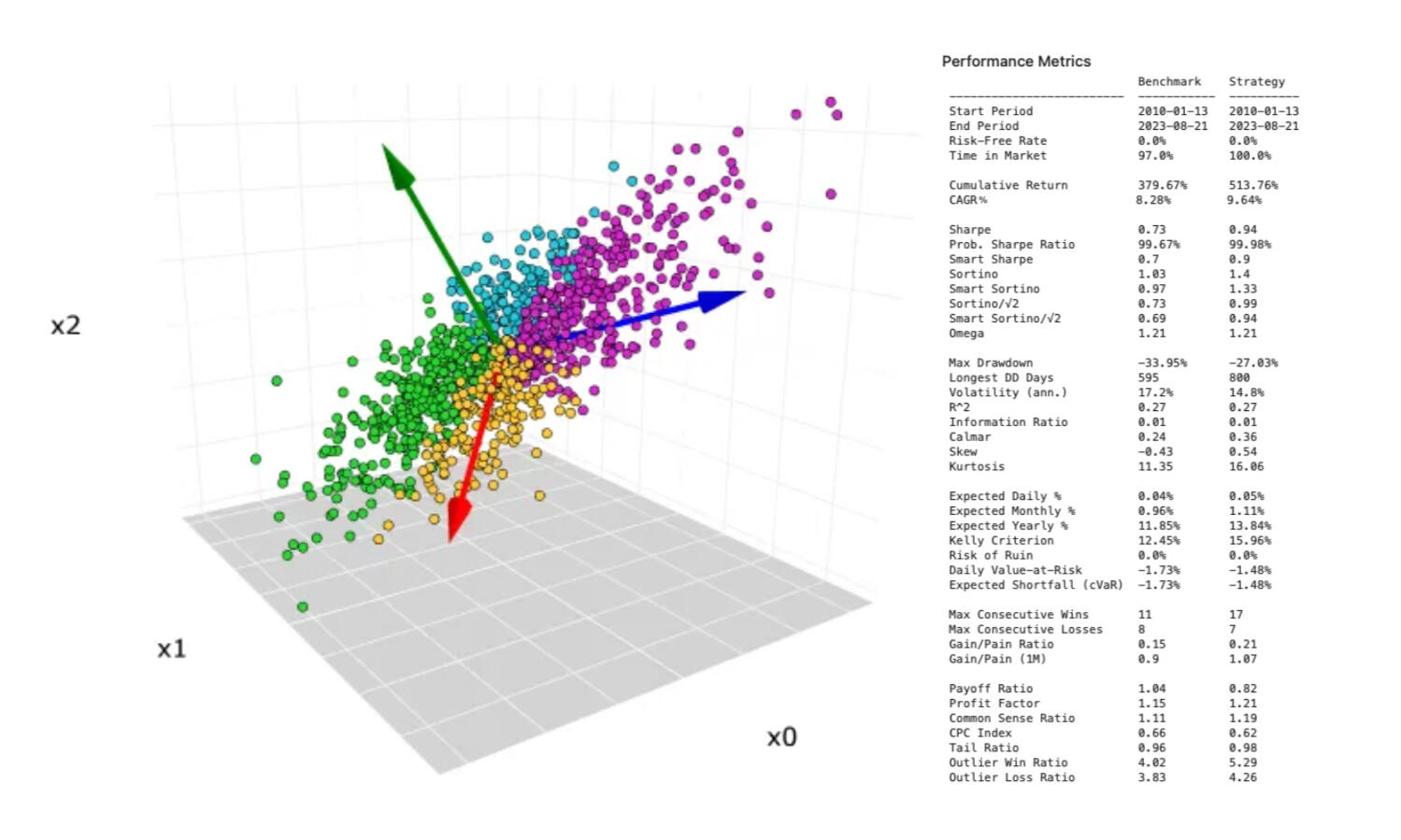

How to Engineer Alpha Factors With Python

Get the tools and techniques professional money managers use to manage portfolios and hedge unwanted risk

Live Session #6:

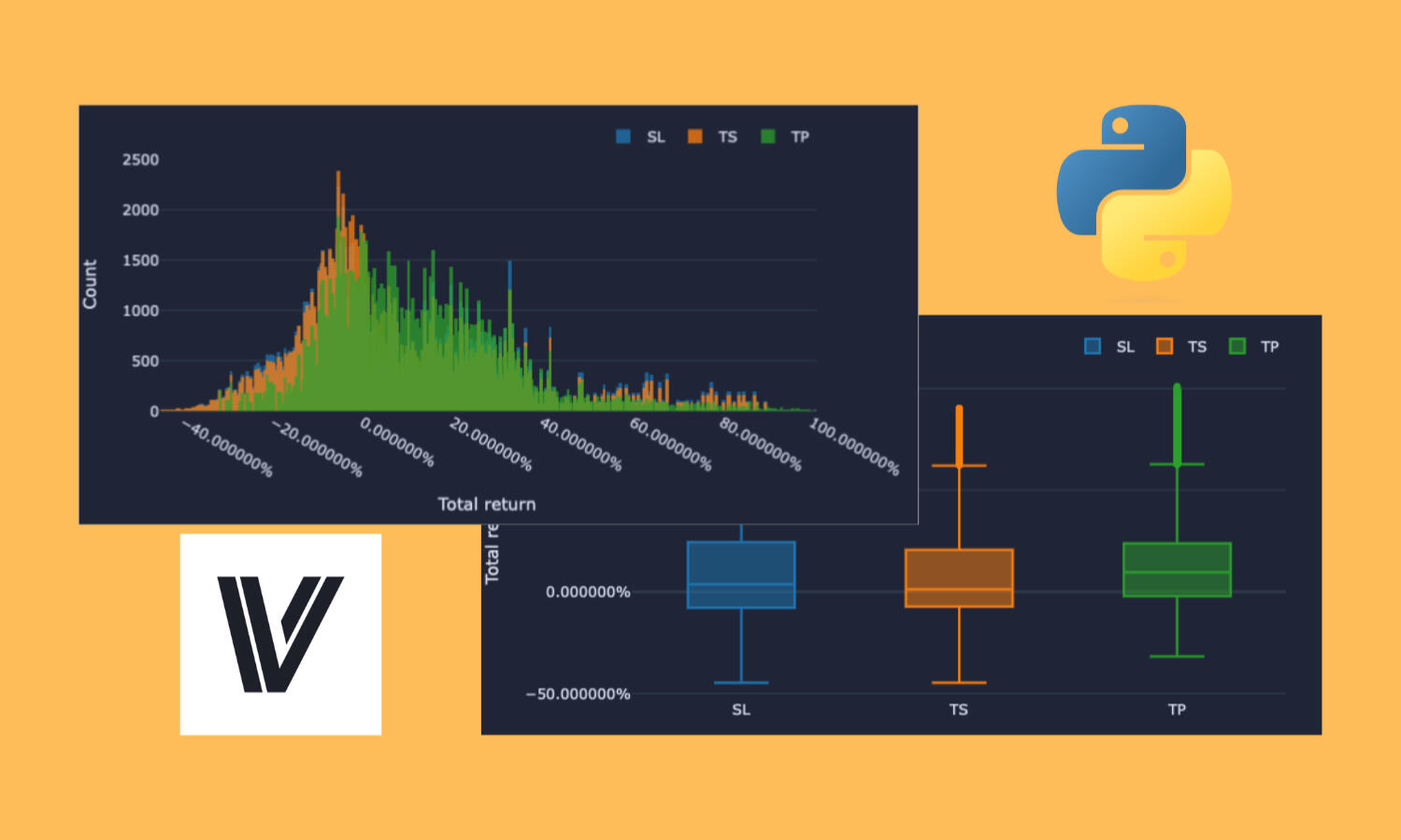

Prototyping and Optimizing Strategies with VectorBT

Get working code to run millions of simulations to optimize your strategy with the cutting-edge VectorBT backtesting library

Live Session #7:

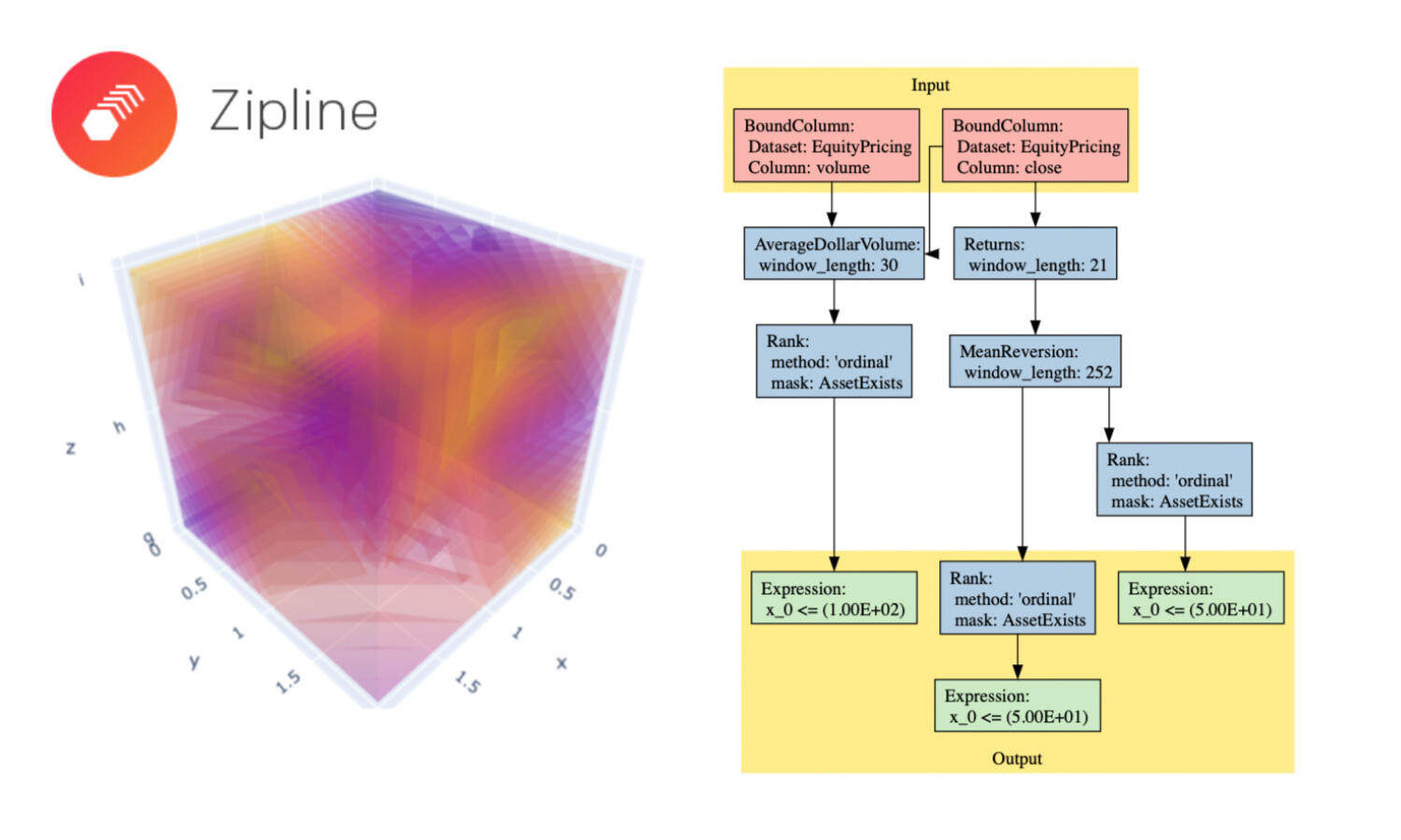

How to Backtest A Trading Strategy with Zipline Reloaded

Build factor pipelines to screen and sort a universe of 20,000 equities to build and backtest real-life factor portfolios

Live Session #8:

Risk and Performance Analysis with PyFolio and AlphaLens

Get the code to quickly asses strategy risk and performance—including factor performance—and assess alpha decay

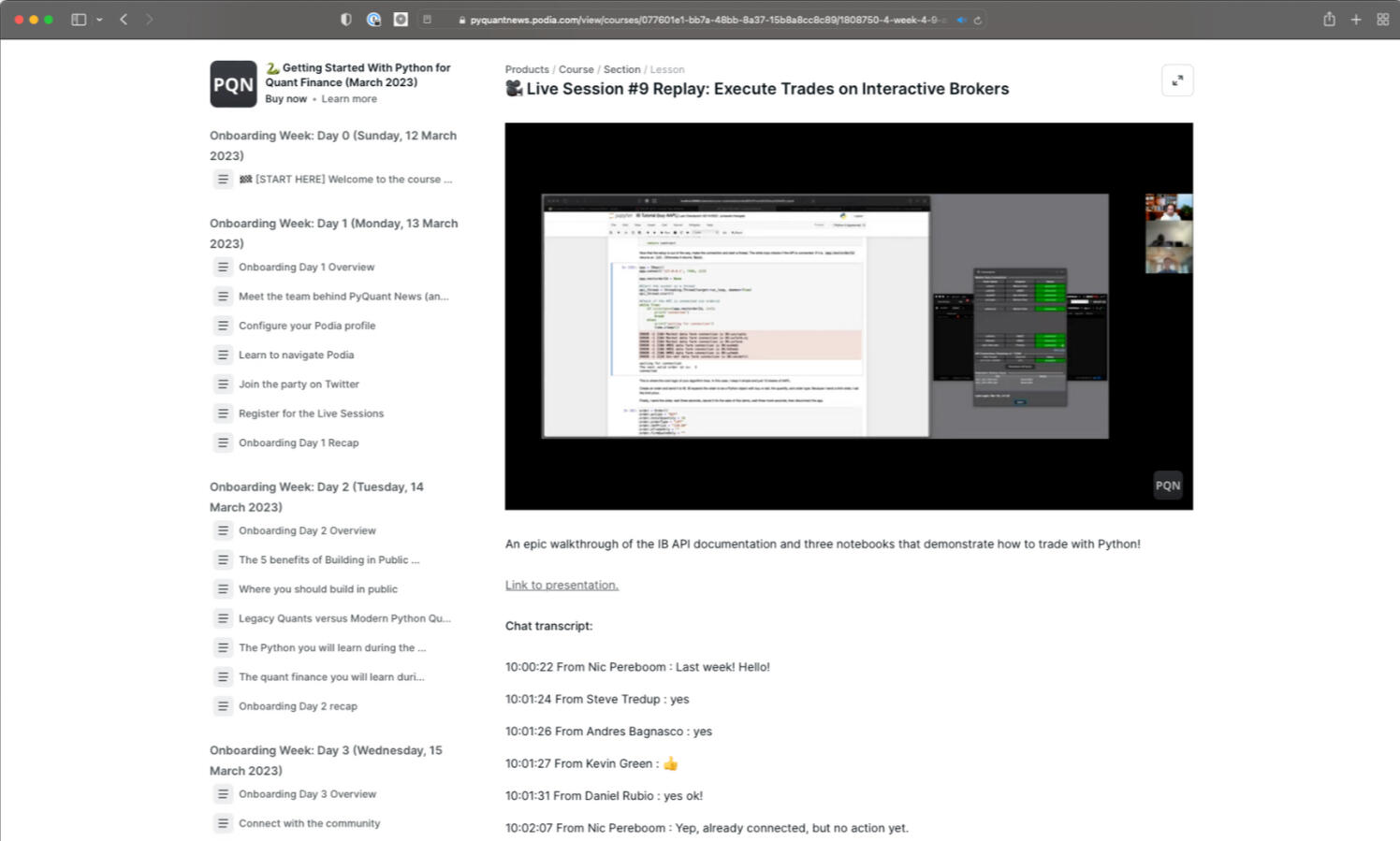

Live Session #9:

Automate Trade Execution with Python

Connect to your broker, download market data, and automate your trades so you can get to trading, faster

Live Session #10:

Double Down on Your Success With More Help and Support

Get expert guidance to take your experience to the next level. More strategies. More code. More support.

Personalized Support:

Office hours sessions to support you in small groups

"No person left behind." Personalized support to leave the course with what you need to move forward with your goals

Industry Speakers:

Get industry insights from industry leaders

Learn directly from the pros, get partner deals, early product access, industry insights, and more with the PQN Partner network

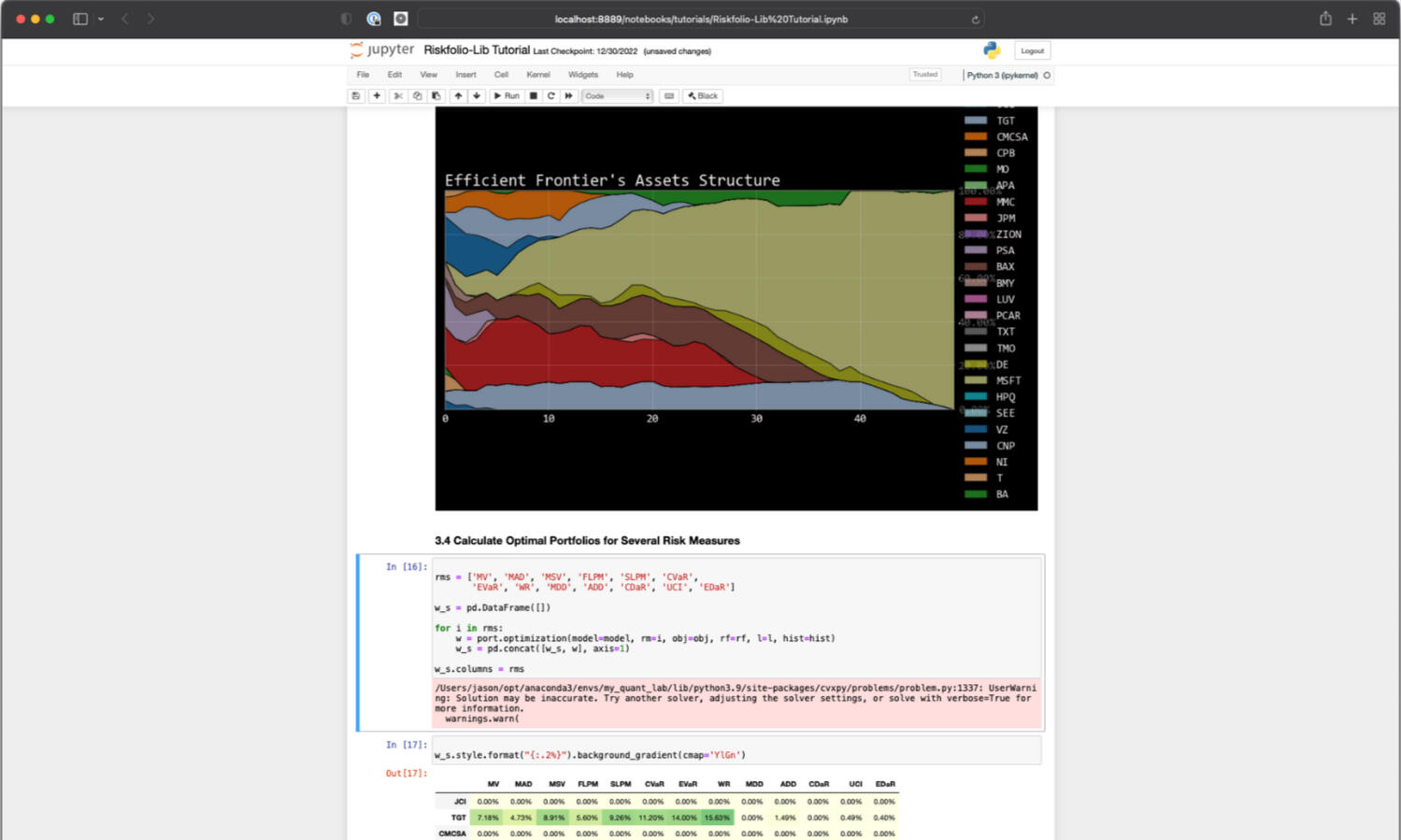

The Recipe Book

In addition to the Live sessions, written curriculum, and PQN Pro community, you get self-paced code "recipe." Each one includes a 20-minute video walkthrough and is packed with code designed to get you started ASAP.

The Recipe Book:

19 code templates—each with 20-minute video walkthroughs.

Get code to calculate trading risk metrics, price an option with the Edgeworth model, forecast volatility with GARCH, simulate stock prices with GBM, hedge beta, use PCA for isolate factors, backtest with Zipline, automate trade execution, and tons more.

Code for portfolio risk and performance optimization

6 code templates and video walkthroughs to build the foundational risk and performance metrics for improving your trading performance.

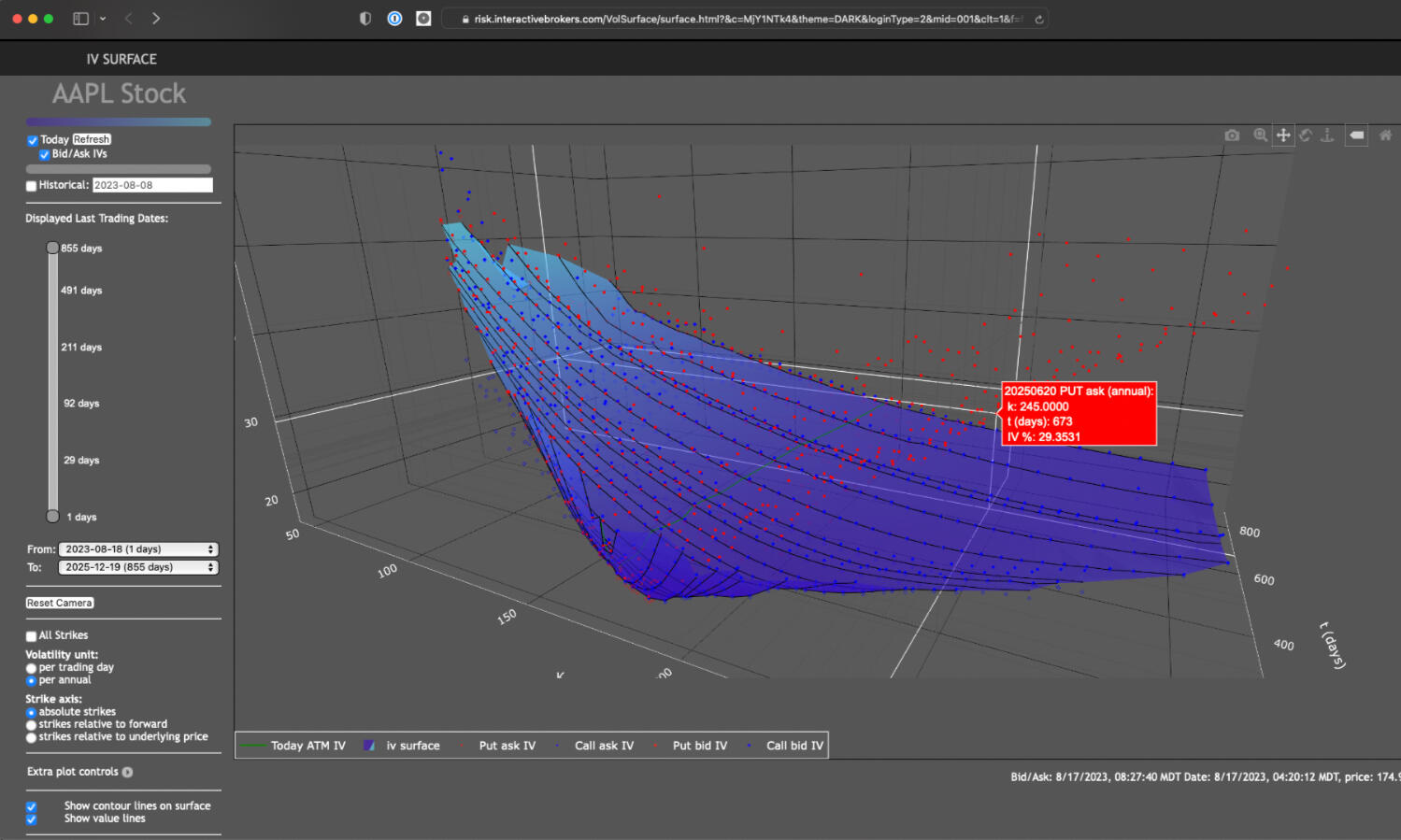

Code to price options and derivatives with Python

4 code templates and video walkthroughs to price options and forecast implied volatility for trading edge.

Code to build factor portfolios and hedge beta

4 code templates and video walkthroughs to reduce risk and build portfolios that make money.

Code to connect to Interactive Brokers and automate trades

5 code templates and video walkthroughs to demonstrate an algo trading system you can modify for your own purposes.

The course gives real quant finance solutions that can be used immediately or modified for my own purposes. That alone is worth taking the course.

Steve Tredup

March Cohort

Getting Started With Python for Quant Finance is designed to work for you, no matter how much experience or time you have (or don't have).

When you begin the course, you have a week of onboarding material that you can absorb at your own pace. If you get stuck, you have a community of 1,000+ people waiting to help you.

Within the first week, you'll have the Python Quant Stack installed, you'll be downloading (free) market data, and you'll be connecting to your broker.

I've explored most of the quantitative finance courses out there and found this to be the most practical and efficient course currently available.If you want to quickly increase your confidence and productivity with Python applied to trading strategies then take this course.

Noah

January Cohort

$4,500+ of free bonuses included

In addition to the Live Sessions, code templates, access to the PQN Pro community, and written course curriculum, you get over $4,500 worth of discounts, freebies, and partner deals.

Up to $1,000 of IBKR

Get up to $1,000 in IBRK stock when you open and fund an Interactive Brokers account.

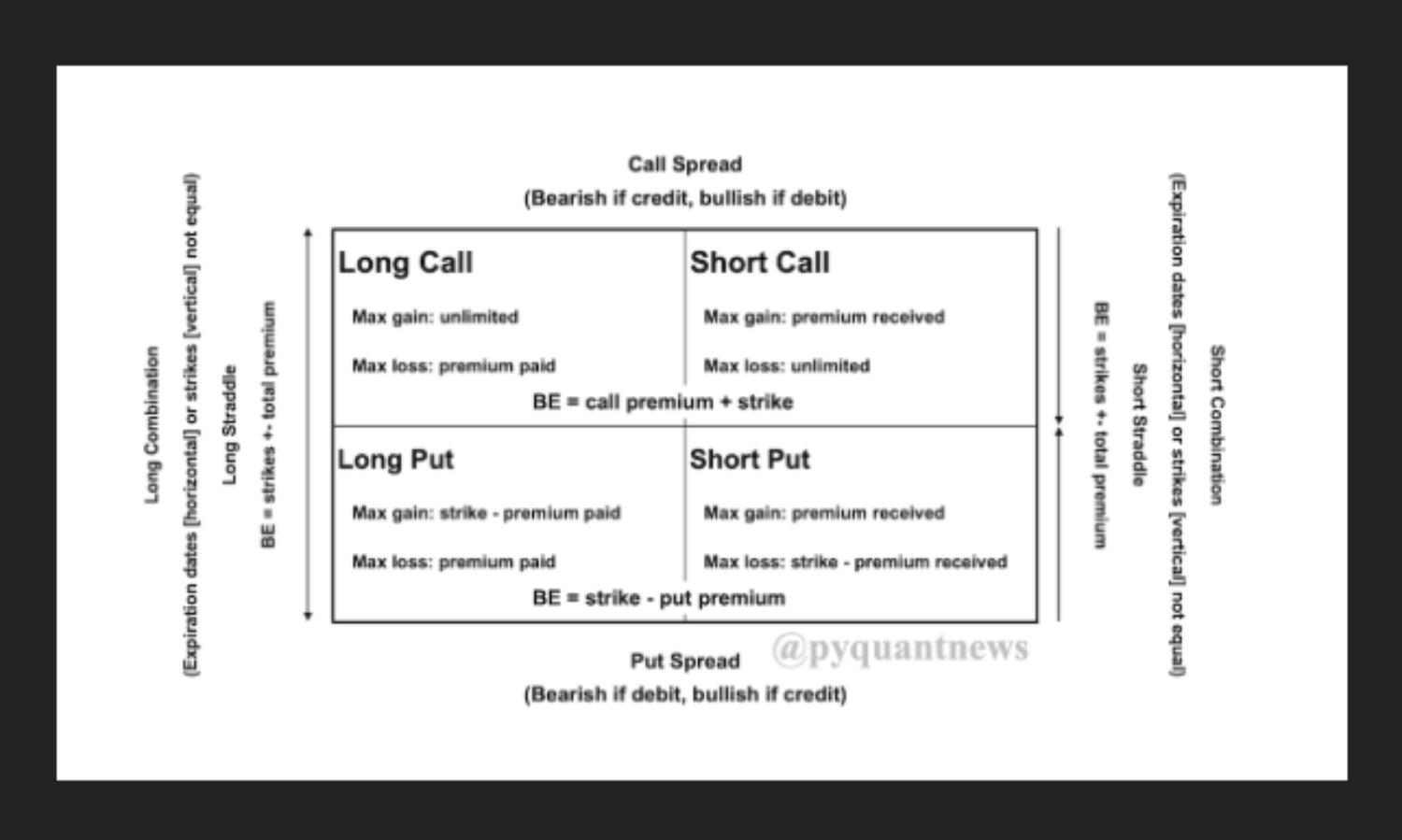

Free cheatsheet

Breakevens are the prices of the underlying where you start to make or lose money.

Free options ebook

Use Python to get live options data, price options, compute the Greeks and implied volatility.

30% off theory ebook

Get the theory behind the Black-Scholes model, binomial trees, the Greeks, and implied volatility.

30% off all cohorts

Join future cohorts of the course for new code, templates, speakers, and lectures for 30% off

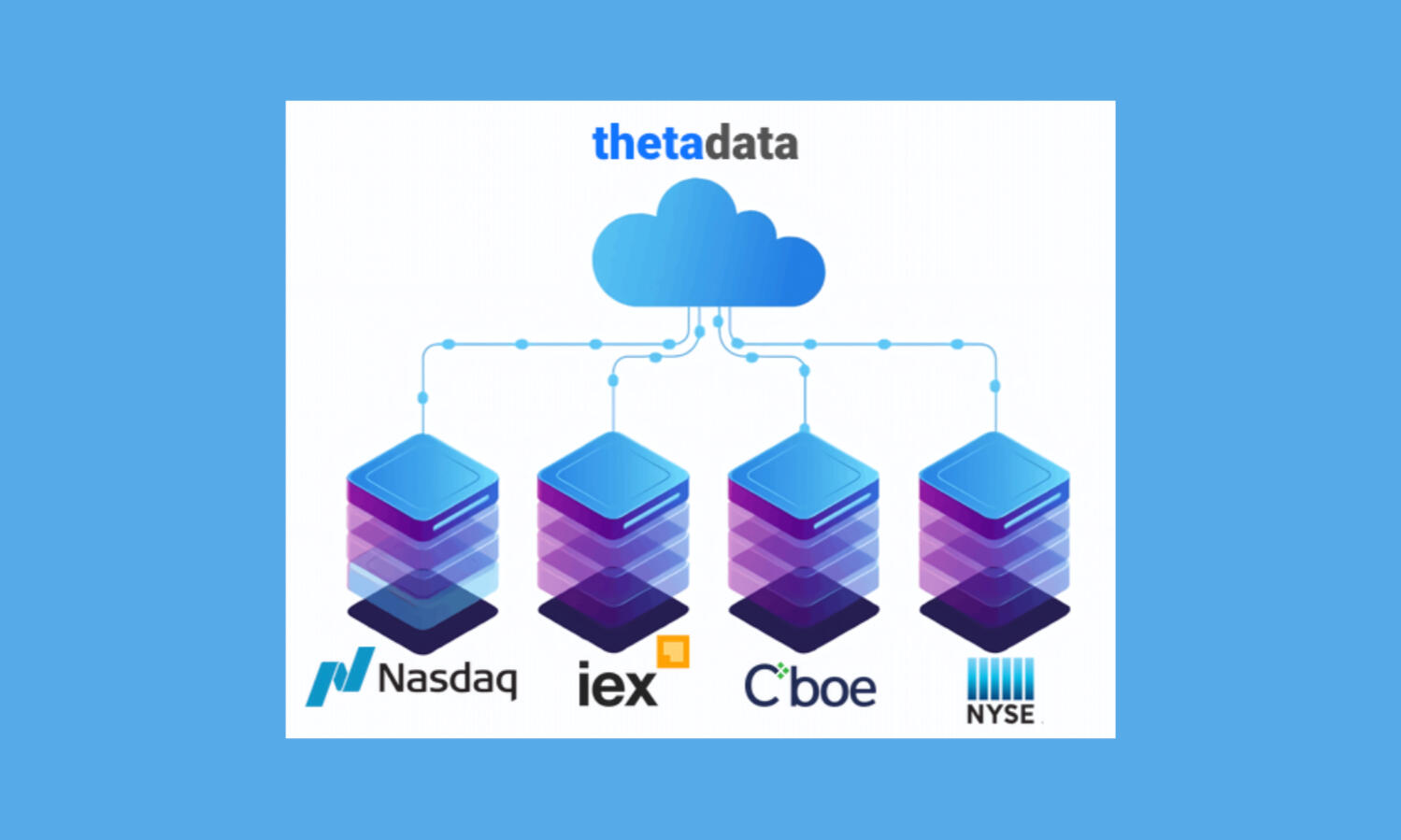

70% off options data

High-resolution, real-time, streaming equity and options data right to your Python API.

50% off access

Automatically analyze your trades to manage risk, monitor performance, and make more money.

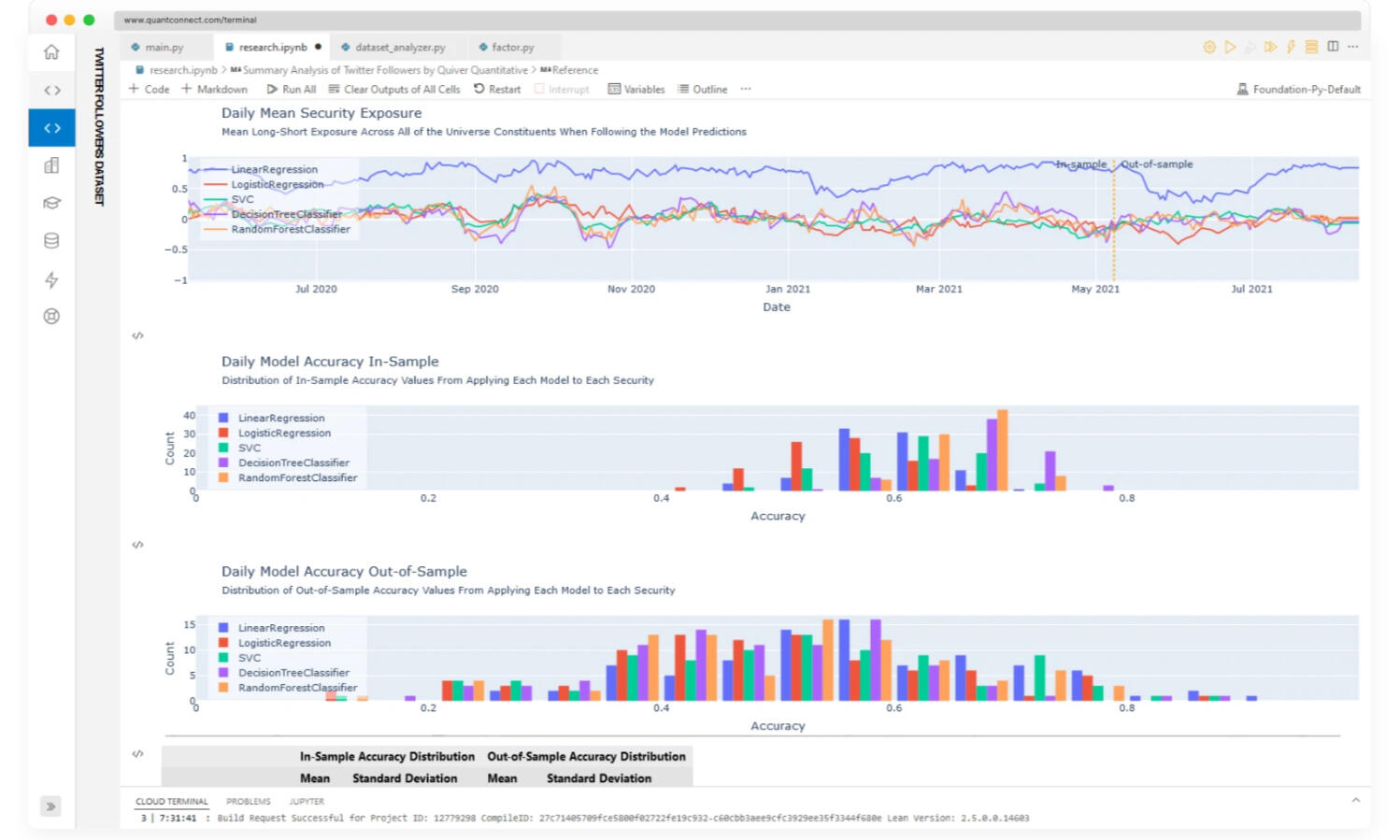

QuantConnect access

Access to hedge-fund quality data and multi-asset backtesting on an integrated platform.

Reference library

Dozens of the best books on Python, markets, trading, and quant finance at your fingertips.

Great course whether you're a beginner or an experienced Python user. The shared notebooks alone are worth multiples of the course cost. I signed up for round 3!

Stacy B, Independent Trader

January, March, and May Cohorts

Course schedule

Course dates: July 21, 2024 - August 23, 2024

All live sessions are recorded. The replay, presentation material, and chat transcripts are available within an hour after the call. Access to the course content and community opens on July 21 at 8:00 am EST.

Live Session #1: Getting the Python Basics Right

Tuesday, July 23, 2024 at 12 PM ESTLive Session #2: The Python Quant Stack

Friday, July 26, 2024 at 12 PM ESTLive Session #3: Algorithmic Trading for Non-Professional Traders

Tuesday, July 30, 2024 at 12 PM ESTLive Session #4: Treat Your Backtest Like an Experiment

Friday, August 2, 2024 at 12 PM ESTLive Session #5: How to Engineer Alpha Factors with Python

Tuesday, August 6, 2024 at 12 PM EST

Live Session #6: Prototyping and Optimizing A Trading Strategy with VectorBT

Friday, August 9, 2024 at 12 PM ESTLive Session #7: How to Backtest A Trading Strategy with Zipline Reloaded

Tuesday, August 13, 2024 at 12 PM ESTLive Session #8: Risk and Performance Analysis with PyFolio and AlphaLens

Friday, August 16, 2024 at 12 PM ESTLive Session #9: Execute Trades on Interactive Brokers

Tuesday, August 20, 2024 at 12 PM ESTLive Session #10: Course Wrap-Up and Next Steps

Friday, August 23, 2024 at 12 PM EST

This course provided me with valuable insights into the practical application of Python in solving real-world challenges, particularly with Financial data analysis and the development of Trading strategies.One unanticipated advantage of this course was the exposure to the OpenBB SDK within Python and other libraries within the Python Quant stack, which has proven instrumental in optimizing my research capabilities!

Ash Tripathi

March Cohort

Get access to the entire program.

Join 1,000+ finance professionals, Python developers, traders, and complete beginners to use Python for data analysis, derivatives pricing, and algorithmic trading.

$1,000

All the guidance, code, and community support you need. Access for life.

Lifetime access to the PQN Pro community, your cohort's Live Session replays, code templates, and written course curriculum

10 live sessions with examples, walkthroughs, and Q&A for students

Industry speakers offering market insights, partner deals, and product demos

Written curriculum to support all the Live Sessions

40+ Jupyter Notebook code templates with real quant code to help you jump-start your coding including 19 with video walkthroughs

Private community of 1,000+ finance professionals, developers, and traders who use Python

Q&A during the Live Sessions to reinforce everything you’ve learned (and make sure nobody gets left behind)

Over $4,500 worth of discounts, freebies, and partner deals

Limited spots available. Payment plan available.

I have no coding experience and no technical background. I went from no direction with Python to having a clear path in a month.

Rey, Financial Analyst

January Cohort

Should you join? Here's what I think...

Not everyone is right for Getting Started With Python for Quant Finance. And while I offer a full guarantee, I want to make sure I don't waste your time.

You'll love this course if:

You want to use Python for getting market data, analyzing the financial markets, backtesting, and automating trading

You're sick of paying Udemy and Datacamp for courses that are irrelevant to your goals

You want a somewhat opinionated approach to installing Python, writing code, and using the Python Quant Stack

You're brand new to Python, quant finance, or both

You realize that taking tutorial after tutorial does not guarantee success. You want to learn and adopt of framework that will make you successful using Python

You don't have time to waste learning a programming language and want to know just want you need

You want step-by-step guidance and structure from someone who's been in the industry for 23 years

You like specific, hands-on instruction and don't have time for the fluff

You'll probably want a refund if:

You'd prefer to learn the theory behind programming and quant finance and not actually apply anything in practice

You prefer "figuring it out yourself" with a plethora of lessons with no clear path

You're hoping that buying a course like this will give you trading strategies that will print you money

You're looking for another Python tutorial that will help you do things like print "Hello World" and the Fibonacci sequence to the screen

You don't really need to use Python in your field and probably won't anytime soon

You're OK with using the tools you have (like Excel) and are unwilling to budge in the slightest.

You're thinking this course will teach you fundamentals of computer science like memory management

You want to use Python to brute force optimize backtests and data mine the market (a bit of an inside joke you'll understand once you dig into the course!)

Five weeks ago I didn't know what quant finance was and I only knew some basics of Python.Since I took the course, a new world has opened to me which will boost my options trading.I consider it one of the best investment decisions I have taken this year.

Nic P, Options Trader

March Cohort

Hi! 👋 I'm Jason.

My name is Jason Strimpel and I'm the creator of Getting Started With Python for Quant Finance.I traded my first stock and wrote my first line of code when I was 18.Since then:☀️ I traded professionally for a hedge fund and an energy derivatives trading firm in Chicago wracking up several millions of dollars in profit.☀️ I was a credit quant looking after $20 billion in credit exposure and managing $100 million of CVA exposure.☀️ I managed a global, quant engineering team that built all the market risk analytics for a $7 billion derivatives trading business.☀️ I built and led the data engineering and quant-analyst team for a $40 billion metals trading business.☀️ I taught myself Python in 2012 to avoid spending $2,000 per year on a MATLAB license after finishing my master's degree in quant finance.☀️ I trade stocks and options in my free time using Python for data acquisition, automation, and execution.My quant career has allowed me to live and work in 3 countries (the United States, England, and Singapore) and travel to 41.I started PyQuant News in 2015 to share what I knew about Python for quant finance. Seven years later, I'm still at it.

Me and my son, Tucker.

The course opened my eyes to what can be achieved at speed with free available data and a clear goal.The concept of Minimum Viable Python that is central to this course has completely changed how I think about using coding to solve problems.The course content is extremely comprehensive and thorough. Jason is a great, committed teacher and helped me personally get started. Highly recommend.

Zac T, Finance Professional

March Cohort

Common questions

"What if I run out of time to get everyone done?"

You have lifetime access to the PQN Pro community, your cohort's Live Session replays, code notebooks, and written course curriculum. That way, you can follow along at your own pace!

"I'm bad at math and feel completely out of my depth. Is this course for me?"

The course goes fast. But since you have 50% discount to the PQN Pro community, you can go at your own pace. Plus you have 1,000+ people that can quickly help you debug your code, answer questions, and get you unstuck to keep learning."How can I trust you?"

I built a business on trust. I am public online and have tied my personal avatar on social media platforms (including LinkedIn where my posts are monitored) to the PyQuant News avatar. 1,000+ people have trusted me to get them outcomes with Python. You can too."Why is your course so expensive when I can take the Udemy one for $19?"

Here's the dirty secret of Udemy, Datacamp, Coursera, Udacity, Code Camp, and others: Their business model requires you to take course after course after course. So they teach the most general topics to the broadest audience possible to get the most users on their platform. Their incentives are not aligned with yours. Mine are: Get you outcomes with Python for quant finance. I lose if you can't use what you learn."What if I can't watch the sessions live?"

All Live Sessions are recorded and available within 30 minutes of the session ending. I have students from 39 countries and 71% of them watch the replays instead of attending live."Does your code work in my market?"

Things like conditional value at risk, factor investing, and options valuation work in all markets. The code templates are meant for you to modify as you need to!"Do I need an Interactive Brokers account?"

No! Of the 40 code templates, 3 of them are specific to Interactive Brokers. 99% of the course is applicable to any broker."I'm completely new to Python. Will this work for me?"

It helps if you have some exposure to programming Python before taking the course. The first Live Session covers the basics of Python and the second Live Session covers the basics of pandas, but it ramps up quickly from there."I'm an experienced software developer. Will this work for me?"

Yes! I've had people in my course that were software engineers for 30 years. These folks can quickly use their experience for quant finance."What if I'm not happy with the course? Can I get my money back?"

I offer a 100%, no-questions-asked refund policy if you complete the course materials and find the course isn't for you within 14 days of the cohort start date."What if I don't have time to take the course but want to attend the Live Sessions?"

I also offer a free rollover policy. That means if you just can't find the time, you can roll over your subscription to the next course—at no additional cost."What's the time commitment"

Life is busy. I know you don't have time to work on Python all day. That's why this course is designed to be done in less than 1 hour per day. There are two live sessions per week as well as a weekly self-paced curriculum.”Can I really learn Python in 30 days?”

On the surface, this might look like an average course on how to get started with Python. But beneath the surface, what you're really getting is an immersive cohort-based course and community that ensures you take action, holds you accountable, and moves you along to get started with Python with ease.

This course helped unlock outcomes because of the community aspect - people asking questions to each other and sharing their code.There were multiple circumstances where I got stuck and was able to pass through by asking questions and leveraging other people's code. The community is the biggest differentiator.

Bobby G

March Cohort

Ready to finally get started?

You've reached the end of the page! I think I've covered all the bases, but rest assured knowing that if for whatever reason you find the course isn't for you, I offer a full money back guarantee.

$1,000

All the guidance, code, and community support you need. Access for life.

Lifetime access to the PQN Pro community, your cohort's Live Session replays, code notebooks, and written course curriculum

10 live sessions with examples, walkthroughs, and Q&A for students

Industry speakers offering market insights, partner deals, and product demos

Written curriculum to support all the Live Sessions

40+ Jupyter Notebook code templates with real quant code to help you jump-start your coding including 19 with video walkthroughs

Private community of ,1000+ finance professionals, developers, and traders who use Python

Q&A during the Live Sessions to reinforce everything you’ve learned (and make sure nobody gets left behind)

Over $4,500 worth of discounts, freebies, and partner deals

Limited spots available. Payment plan available.

Your payment is complete!

A payment to PQN Quant Course will appear on your statement.

You just took the first step to finally get started with Python for quant finance.

Here's what to expect next:

Today: A welcome email with a few action items for you to get ready for the course (check your email now!)

Tomorrow: An email with instructions on how to download your FREE copy of The Ultimate Guide to Pricing Options and Implied Volatility (your 1st BONUS)

The next day: An email with instructions how to download your FREE copy of the Options Breakeven Cheatsheet (your 2nd BONUS)

The next day: An email with instructions on how to get 50% lifetime discount for Trade Blotter (your 3rd BONUS)

July 21st: The Onboarding Week kick-off email that gives you the details for Onboarding Week, about how the course works, and how to access the content